Why 2MC?

The debate measuring the virtues, values, and validities of passive/index-centric investing contrasted against actively managed or tactical investment programs has grown to a full boil. Measures of fund flows and the nearly universal consensus of the financial media indicate passive/indexed investing is winning the battle. Money is pouring into passive index ETFs and out of actively managed portfolios.

The debate balances on empirical evidence that active managers, over the last decade and more, have charged higher fees while failing to match the returns of their benchmarks. Passive ETFs, with a low fee structure, have nearly cloned index returns.

The problem lies in that index returns, historically, have not produced profits sufficient to achieve investor goals.

Stubbornly, 2nd Market Capital pursues a better result. Through exhaustive fundamental securities analysis, sustained macro-economic awareness, and an ever presence in the markets, we continuously attempt to maximize our investment returns.

2nd Market Capital provides hyperactive investment management. We aim to produce results that realize investor goals.

Philosophy

At 2nd Market Capital we seek to capitalize on mispricing by maintaining a deep knowledge of the REIT universe. Noise and sentiment swings frequently bring about mispricing, but it is often fleeting and obscure. Our preexisting knowledge base, which we work tirelessly to maintain, allows us to pounce on opportunities as they arise and act decisively to minimize adverse results.

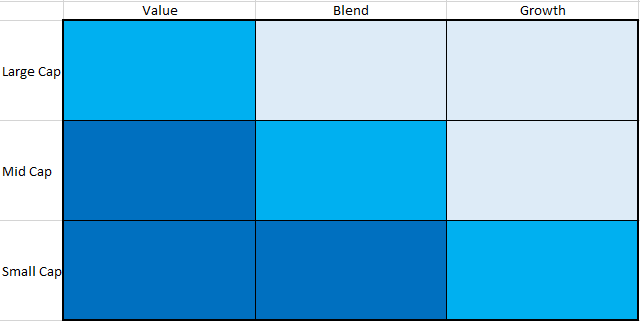

Style Box

While our philosophy and process do not require a particular style, our historical tendency is to be small cap and value.

It is in the small cap value space that our competitive advantage is at its greatest. While we consider ourselves knowledgeable on all things REIT and REIT-adjacent, the market is also knowledgeable on the massive REITs. It is in the small, the cheap, and the obscure that we have a relative knowledge advantage.

Allocation of Research

Alpha is ubiquitous; thousands of stocks outperform each and every year. The trick is to find a research process that affords consistent discovery of positive alpha. There is an inherent trade-off in the allocation of research hours. One can develop broad investment knowledge or deep investment knowledge, not both. At 2nd Market Capital, we have limited our investment universe to REITs and REIT-adjacent securities, such that we can go very deep. We remain unconcerned with all the potential alpha that exists outside of REITs; someone else will find it. Instead, we focus 100% of our effort on finding alpha within REITs and REIT-adjacent securities and avoiding negative alpha within REITs. We believe superior depth of expertise provides us with the best possible chance of outperforming on a consistent basis.

Investment Process

Our investment process consists of balancing a variety of factors such as quality, valuation, management, diversification, and trading history among others. At any given time we try to maintain a portfolio with the best combination of these factors. If company A becomes better than a current portfolio holding, the portfolio holding is swapped out in favor of company A. All portfolio holdings are measured against their opportunity cost and only remain holdings as long as they are superior to the next best possible investment. In some instances of extreme overvaluation of the market, the next best possible investment can be cash.

Our Team

Ross Bowler

Chief Executive Officer

Ross Bowler is the founder and CEO of 2nd Market Capital Advisory Corporation, a specialized securities analysis, and investment advisory firm focused primarily on the 200+ companies structured as publicly traded Real Estate Investment Trusts (REITs), with over 30 years of experience trading and analyzing real estate securities. Since 2003 Ross has been designing and managing REIT and REIT-adjacent portfolios tailored to our advisory clients’ investment goals. With a pre-existing knowledge of each REIT and relationships with REIT management teams, he has an advantage in knowing which REITs to buy and which to avoid.

Robin Sherman

President and Chief Operating Officer

Robin Sherman is 2nd Market Capital’s President and Chief Operating Officer.

Dane Bowler

Chief Investment Officer

Dane Bowler is 2nd Market Capital’s Chief Investment Officer. With more than 10 years of investment advisory experience, Dane manages 2MCAC’s proprietary Investment portfolio, REIT Total Return. Dane earned his MBA from the University of Wisconsin Business School Applied Securities Analysis Program. As a dedicated REIT analyst, Dane has authored more than 600 articles on REITs and Investing on Seeking Alpha. On-site property tours and critical analysis of REIT management help him separate the wheat from the chaff.

Simon Bowler

Chief Communications Officer

Simon Bowler is 2nd Market Capital’s Chief Communications Officer. He measures and presents reporting that fairly and accurately reflects the performance of our investment portfolios. Simon earned his MBA with a focus on real estate and urban economics from the University of Wisconsin Business School. This academic background provides an understanding of property NOI waterfalls and helps determine how acquisitions will impact the bottom line. Simon also produces the State of REITs, a monthly publication that thoroughly examines REIT sector data and trends.

Investment advisory services offered through 2nd Market Capital Advisory Corporation (2MCAC). 2MCAC is registered as an investment advisor in the state of Wisconsin and is licensed to do business in any other state where registered or otherwise exempt from registration.

View disclosure information for 2nd Market Capital Advisory Corporation and our investment professionals by visiting the SEC Investment Advisor Public Disclosure website.

Copyright 2025 2MCAC | Website built and maintained by Jack Knesek