Portfolio Asset Management

Baseline + Asset Management Accounts

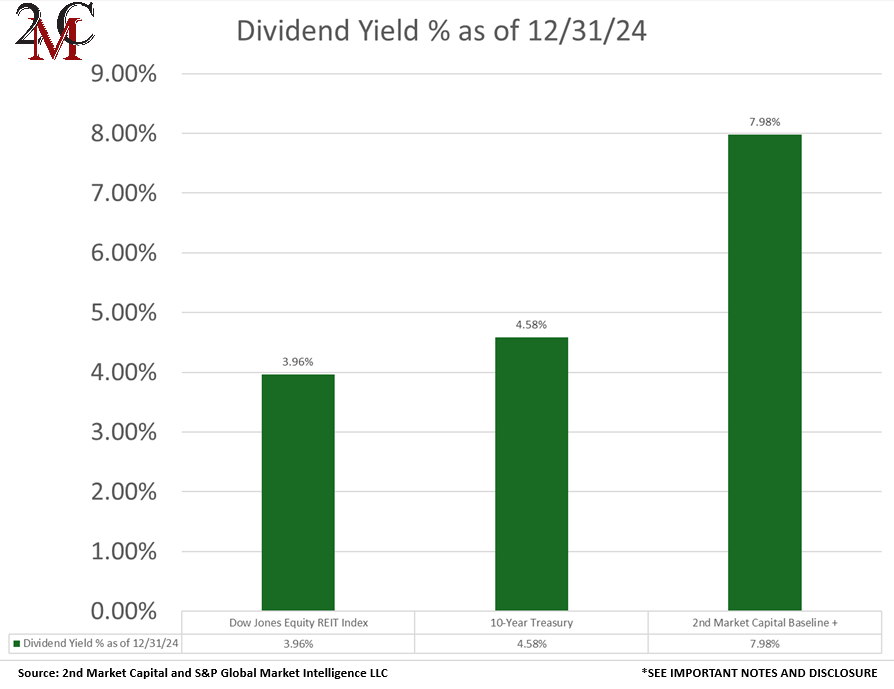

Our Baseline + Asset Management Accounts are actively managed with investing focused on a dividend yield spread over Treasuries and Corporate bonds (the Baseline). Investing primarily in discounted preferred REIT shares and discounted common REIT shares with a goal of capturing capital appreciation (the +).

Proprietary Investment Portfolio

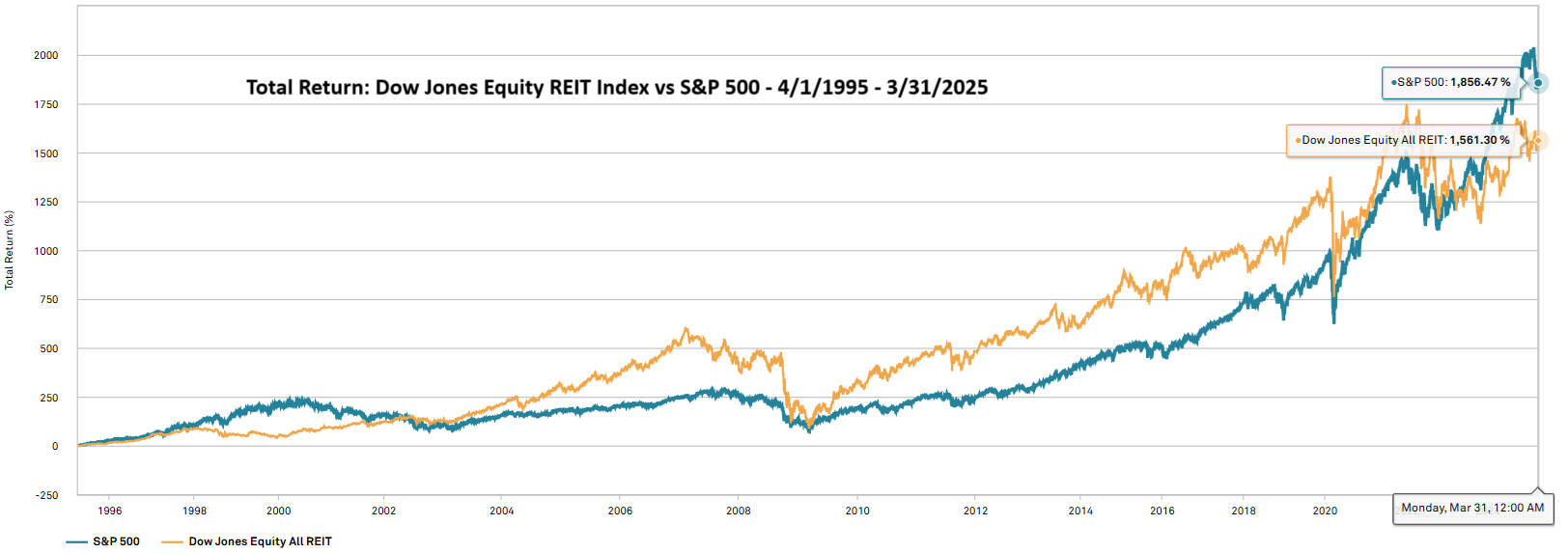

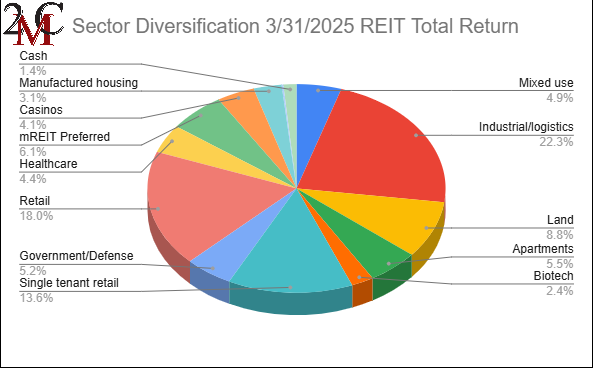

The REIT Total Return Investment Portfolio is actively managed with the goal to generate high returns from a mix of dividends and capital appreciation. It consists of 10-20 hand-selected stocks from a pool of more than 175 tax-advantaged real estate equities, primarily common and preferred shares of Real Estate Investment Trusts (REITs).

Research

Our Portfolio Income Solutions, offered through Seeking Alpha’s Marketplace service, provides stock picks, extensive analysis, and data sheets to help enhance the returns of do-it-yourself investors.

Sub-advisory Portfolio Curation for Financial Professionals

As its sub-advisory service, 2nd Market Capital Advisory Corporation applies its investment experience to building and maintaining a curated portfolio which serves as guidance that the advisor can apply to whatever extent is desired. Sub-adviser will send periodic updates in an effort to keep the adviser informed of real-time opportunities and analysis of current events.

Contact Us

2nd Market Capital Advisory Corp

650 N. High Point Road

Madison, WI 53717

(608) 833-7793 - phone

info@2ndmarketcapital.com

Investment advisory services offered through 2nd Market Capital Advisory Corporation (2MCAC). 2MCAC is registered as an investment advisor in the state of Wisconsin and is licensed to do business in any other state where registered or otherwise exempt from registration.

View disclosure information for 2nd Market Capital Advisory Corporation and our investment professionals by visiting the SEC Investment Advisor Public Disclosure website.

Copyright 2024 2MCAC | Website built and maintained by Jack Knesek