Market Commentary | January 20, 2025

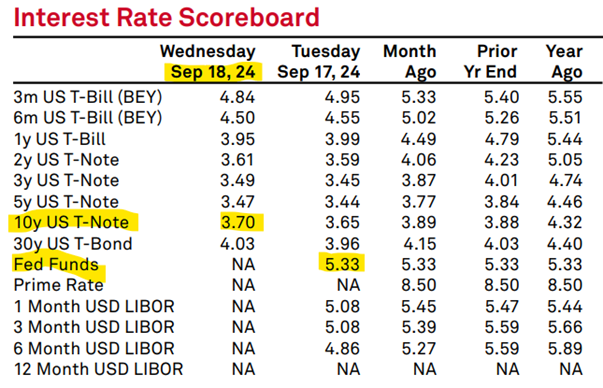

A funny thing happened during our long wait for lower interest rates. On September 18th, Jerome Powell finally began reducing short-term borrowing costs with a 50-basis point cut to the Fed Funds rate. At the time, 10y US Treasuries were yielding 3.70%.

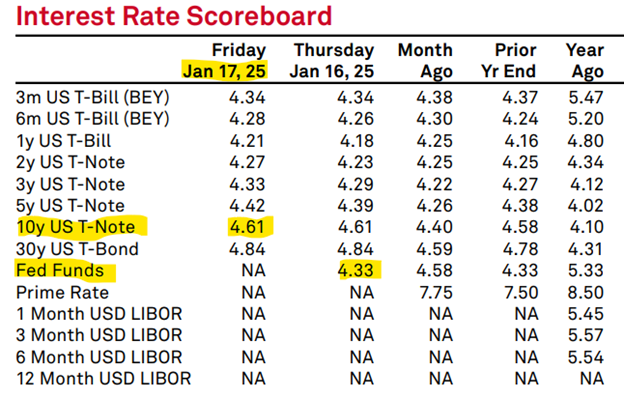

In subsequent meetings, two additional cuts were implemented bringing the Fed Funds rate down a full 100bp from the starting point. We don’t always get what we wish for; in this case, it was very painful for fixed-income investors. The 100bp reduction in short-term rates managed to be added to the 10y yield.

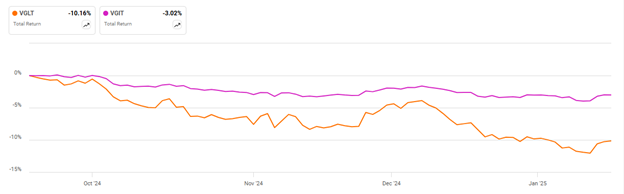

Since bond prices and yield have an inverse relationship, this translated to significant losses across a broad duration-spectrum of fixed-income investing. The Vanguard Long-Term Government Bond ETF (VGLT) and Vanguard Intermediate-Term Government Bond ETF (VGIT) illustrate this effect.

Rolling with the Changes

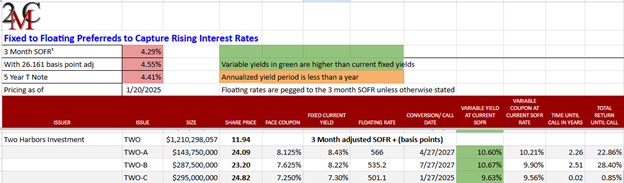

In our early efforts to address first rising interest rates/inflation and now declining rates, we looked to the high-yield opportunities in REIT preferreds. The fixed-to-floating issues offered growing income, no matter how high rates would climb; the steep discounts to par offered attractive capital appreciation potential if interest rates ever declined.

The passage of time and current market conditions present a new opportunity in the realm of fixed-to-floating preferreds. On 01/27/2025, just one week from now, Two Harbors Investments 7.25% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred (TWO-C) converts to a floating rate coupon. After January 27, the issue will pay a dividend of 501.1 basis points over adjusted 3-month SOFR or 9.56% as measured against a $25 par value.

We have observed that markets for these thinly traded preferred issues are slow and inefficient, which often creates price dislocations. Those dislocations are now exhibited in the absence of market price declines during rapidly rising interest rates. The issues have been good placeholders in preserving our capital, producing outsized yields, and providing sufficient liquidity to favorably supply capital for the pursuit of opportunities like TWO-C as they emerge.

Ready

Later this year we will see similar fixed-to-floating conversions of issues from AGNC, Chimera, Dynex, and others. No one knows the direction of interest rates, but a thorough understanding of our investment universe, ceaseless vigilance, and constant market presence keeps us ever ready.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.