Market Commentary | November 19, 2024

Which Way Go Rates?

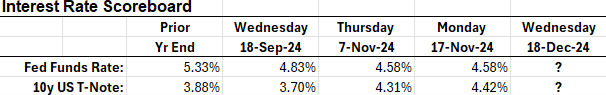

As anticipated, on November 7th the Fed followed up on September’s 50 basis point rate cut with an additional 25 basis point reduction. The broader bond market, however, seems to be living in an entirely different macroeconomic universe. While the Fed Funds rate is now 75bp lower than when the easing began, yields on 10Y Treasuries have headed in the opposite direction.

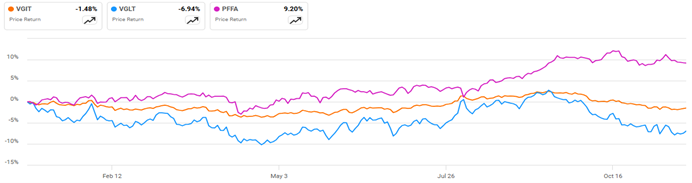

Fixed income investing is always tricky, but 2024 began with expectations of six rate cuts and instead proceeded with just two (so far) and a couple of dozen head fakes. The markets evolved to deliver declining bond prices and more issue dislocation. With ETFs as representative of what happened in fixed-income investing, we can see that prices of intermediate-term Treasuries (VGIT) declined about 1.5%, long-term Treasury prices fell almost 7%, and, in the same environment, preferred stock prices, on average, rose more than 9%.

The preferreds’ strong performance indicates that their relatively thin and illiquid markets caused them to be significantly oversold (price dislocation) when interest rates were climbing in 2022 and 2023. That’s where we come in; our approach to fixed-income investing begins with optimizing yield but has discounted pricing and a capital appreciation potential component as well.

A more granular example would be what we experienced with Chimera Investment 8% preferred Series A (CIM-A). In July we bought shares in the $22.50 range which provided a dividend yield of 8.9% and a potential 11% upside to par. By the end of September, while rates had begun rising, CIM-A’s share price had risen to $24.50. Simultaneously, Chimera Investment 7.75% Fixed-to-Floating preferred Series C (CIM-C) was languishing in the $22.25 to $22.75 price range. Since both stocks were from the same issuer, the positions were effectively fungible allowing us to sell CIM-A, buy CIM-C with proceeds, boost our yield, and replenish the potential capital appreciation. It was so obvious, that’s what we did.

Where interest rates are headed is anybody’s guess. In the interim we’re always present in the market trying to buy issues like Arbor Realty 6.25% Fixed-to-Floating preferred Series F (ABR-F). Currently trading at about $20.50, if interest rates fall, the share price might rise to par. If interest rates don’t fall, ABR-F converts to floating in October 2026 and will begin paying SOFR +474.3 basis points (currently 9.52%) and the share price might float up to par. Opportunities abound.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.