Market Commentary | March 25, 2025

Peak Uncertainty

We always adhere to the discipline that “if the market is open, we’re here”. The objective is to spot opportunity when it appears. Since the Fed started raising interest rates in March of 2022, however, opportunity sightings seem to have grown scarce and fleeting in our universe of real estate value and growth.

To bring context to our analysis and trading, we watch a lot of Business News TV. All through 2024, CNBC produced a seemingly unending stream of pundits who talked themselves blue in the face about the value and unlimited potential of the Magnificent 7 stocks (even though these issues, on average, had already doubled in value). Artificial intelligence was changing the world, the Mag7 are all about AI, and REITs are not.

In January of this year, a Chinese startup called DeepSeek released an AI app that was reportedly built for a fraction of the cost of ChatGPT or other much ballyhooed U.S. AI apps. The unshakable Mag7 started to waver and took the rest of the stock market (and REITs) with them. By the week ended March 21st, the S&P 500 was officially in correction territory, down 10% from recent highs.

At this result, investors are beside themselves. Two years of double-digit stock market returns apparently made them amnesic of the pain a correction brings. Combine the decline in asset values with inflation, which remains too sticky to allow further interest rate cuts and tariffs that are on one day and off the next, and a heightened level of uncertainty sets in. According to reporting from CNBC’s Mike Santoli, once economic uncertainty peaks, forward equity performance is better than average.

Real Estate – Tangential, but a World Apart

We find it strange that while REITs didn’t ride the AI crest to higher share prices, a bludgeoned investor sentiment stopped REITs from trading up on their strong earnings reports. The consternation only grows when you consider that we have just concluded a pretty strong 4Q24 earnings season.

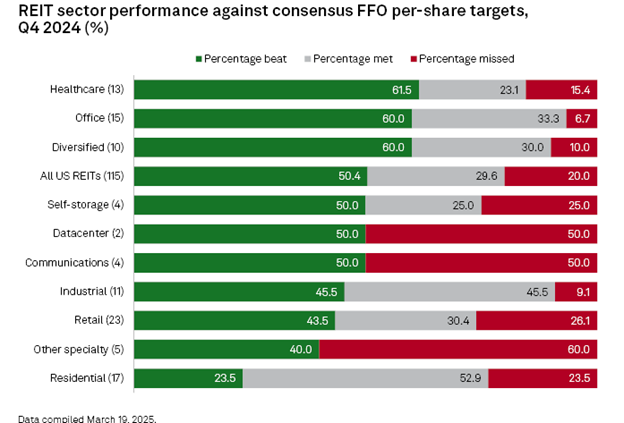

In a recent analysis of 115 equity real estate investment trusts, S&P Global Market Intelligence concluded that just over half reported FFO/share above consensus estimates. Another 29.4% reported results in line with expectations, and the final 20% fell short of consensus estimates. In other words, 80% of companies performed as well or better than expected.

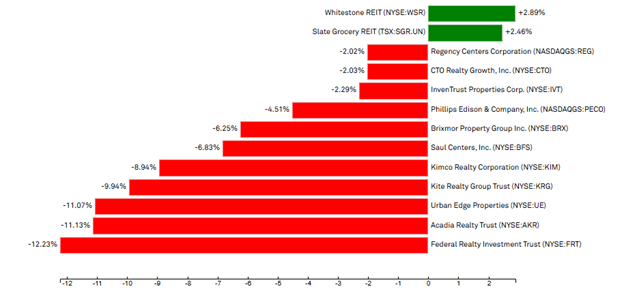

These results are impressive, but they have failed to make a positive impression on the market. If we look at the shopping center REITs, you can see that share prices have headed in the opposite direction of earnings results.

Sector Spotlight: Shopping Center REITs YTD 03/24/2025

As a group, retail REITs reported historically high occupancy, double-digit rent growth in leasing activity, and most have raised their earnings guidance and dividend payouts. On average, their stocks are trading at just 13.4x 2025 FFO estimates and 82.1% of consensus Net Asset Value. They pay dividends ranging from 3.8% to 8.5%, and earnings growth forecasts support expectations that those yields will rise.

Similar results and trends are demonstrated in multifamily, industrial, healthcare, manufactured housing, and other real estate sectors.

Not Waiting for Peak Uncertainty

Our universe of real estate investment is largely sourced within the United States and will therefore be unaffected whether tariffs arrive, or not. Real estate borrowers have largely survived rising interest rates over the last few years and will continue to survive if interest rates are lowered further, or not. Share prices have fallen in the face of rising earnings.

We’re certain. Real Estate fundamentals are confirmed strong. Opportunities abound. We will wait no more.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.