Market Commentary | February 24, 2025

Selling the News

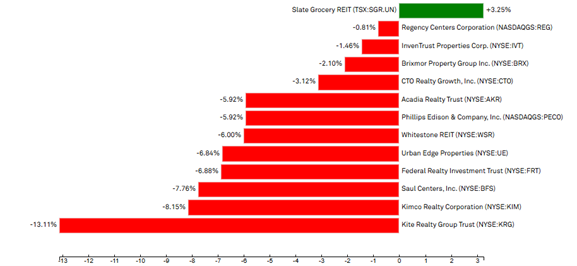

Reading the February 2025 edition of The State of REITs, I was surprised to learn that Shopping Center REITs were the second worst-performing sector in January (down 6.46%). For almost three years now, we’ve been unabashedly bullish on retail real estate and the market has rewarded us. However, at the start of 2025, despite nearly universally strong 4Q earnings for the sector, some trepidation has set in, and the selling has continued throughout February.

Sector Spotlight: Shopping Center REITs Y-T-D 2025

A Remedy for Seller’s Remorse

Though we have remained bullish, respect for fickle market sentiment encouraged us to prudently trim our shopping center positions last year as share prices rose. As strong leasing demand continues, both occupancy and rents are climbing, and we feared we had become under-exposed to the retail sector. Successive earnings reports revealed strong same-store NOI, double-digit lease roll-ups, and dividend hikes. Then the selling accelerated.

On 02/12, Kite Realty Group (KRG) reported strong leasing, rent growth, and a strong balance sheet; the shares are down 13% YTD. After market close on Thursday 02/20, CTO Realty Growth (CTO) announced acquisition activity and a strong leasing environment; shares fell as much as 10% in early Friday trading. Whitestone REIT (WSR) has not yet reported, but the shares were recently trading at a double-digit discount to the $15 cash buyout it rejected last summer. All shopping centers are reporting near-record operations; all of their shares are priced in the doldrums.

The retail real estate sector has just reported its tenth quarter of FFO growth and guides for more of the same in 2025 and 2026. We bemoaned our prior exit from some of these positions, but a nervous stock market has cured our seller’s remorse and provided the opportunity to re-enter at significant discounts to our exit prices. Portfolios will soon hold more of these familiar names and new retail operators as well.

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.