Market Commentary | December 23, 2024

Short Term Pain, Big Potential Gain

In January I will begin my 42nd year as a professional investor. Markets are always changing but there is a generally recurring rhythm and calendar. To varying degrees, a constant within that calendar is a November and December Tax Loss harvesting season. Sometimes the effects of this selling are muted by a buoyant stock market, but in December 2024, as we awaited new commentary from the Fed on the status of future rate cuts, things got wild. On December 18th, we got a 25-basis point cut but were effectively told not to hold our breath in waiting for the next one.

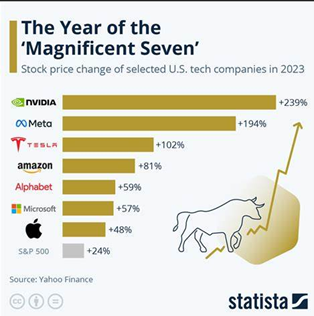

When you consider that the Magnificent Seven stocks doubled in 2023 and followed that with a blended gain of approximately 60% in 2024 and that their cap-weighted influence on S&P 500 returns continues to grow, this fall was set up to be one of the biggest tax loss selling seasons in history.

If prudent portfolio re-balancing came with huge capital gains tax liability, investors felt a sustaining urgency to harvest losses to wash those gains. Our premise is that many of the issues sold to generate offsetting losses have fallen to extremely discounted values. As examples, consider recent trading/valuations in some REIT issues.

Healthcare

Global Medical REIT (GMRE) owns a geographically diverse portfolio of outpatient healthcare facilities that should benefit from the healthcare needs of our aging population. GMRE began the year trading at $11.07 so its recent pricing in the low $8 range might make it a good candidate for tax loss selling. If you consider that GMRE started 2022 at $17.83/share the harvestable tax loss could be really amplified.

Consensus estimates show the Healthcare REIT sector trading at median prices of 13.2x AFFO and 98% of NAV. By contrast, at $8.00, GMRE is trading at 8.8x AFFO and 70% of NAV.

Industrial

Plymouth Industrial (PLYM) owns manufacturing and industrial properties in the central United States. PLYM began the year at $23.92 but started 2022 at $31.37/share. At $18, PLYM is also ripe for the harvest of tax losses.

Industrial REITs have had a rough year and now trade at 80% of consensus NAV and 18.3x AFFO. PLYM trades at 85% of consensus NAV, but just 10.3X AFFO.

Office

The much maligned and troubled Office REIT sector trades at 12.0x consensus AFFO and just 76% of NAV. With anticipated low demand and record-high vacancy rates, there is currently very little investor optimism for the sector.

Easterly Government Properties (DEA) owns mission-critical office and healthcare assets leased to agencies of the US Government throughout the United States. Though it is lumped into the office sector, DEA is really more like a fully occupied, Net-lease portfolio operator with long-term, investment-grade rental contracts.

DEA began the year at $13.47 but started 2022 at $ 22.95 so it may indeed be experiencing some tax loss selling. Trading at 76% of NAV and 12.0x AFFO, its recent $11 share price values it like other office REITs. We think its value is much higher.

Patience Presents Opportunity

Being buffeted by investor anxiety in a market sell-off is painful while it lasts. We are enduring the downdraft and identifying opportunities that could enrich us when valuations normalize early next year.

We wish you a wonderful holiday season and a happy new year!

Notes and Disclosure

Articles are provided for informational purposes only. They are not recommendations to buy or sell any security and are strictly the opinion of the writer. The information contained in these articles is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions.

Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

Past performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Although the statements of fact and data in this report have been obtained from sources believed to be reliable, 2MCAC does not guarantee their accuracy and assumes no liability or responsibility for any omissions/errors.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Hypertext links to other sites are provided strictly as a courtesy. When you link to any of the sites provided on our website, you are leaving this website. We make no representation as to the completeness or accuracy of information provided on these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites to which you are linking.

Discover more from 2nd Market Capital Advisory Corp

Subscribe to get the latest posts sent to your email.